General Electric (GE) Stock: Too Many Uncertainties Ahead, Hold

Jetlinerimages/iStock Unreleased through Getty Photos

Thesis

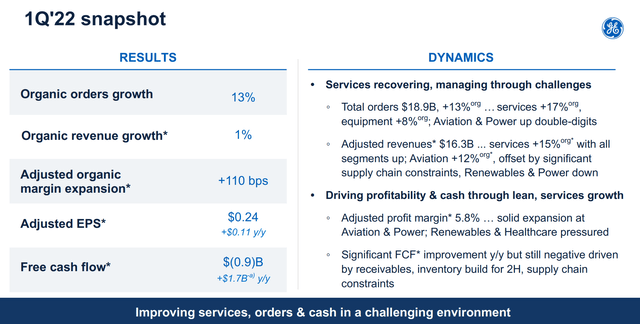

General Electric powered (NYSE:GE) reported blended outcomes for Q1 2022. On the positive aspect, full orders reported a stable 13% progress, and natural profits also grew by 1% amid supply modify disruptions, travel recovery, and COVID lockdown in China. Its aviation section is the vivid location. The two civilian and navy product sales are robust. Military services gross sales need to be a major-line driver likely forward, in opposition to the backdrop of protection budget increases close to the globe and its progress to supply its XA100 adaptive cycle engine to the two the F-35A and F-35C jet fighters.

On the damaging side, free of charge money circulation was even now an outflow of $.9B, the credit card debt stage is nonetheless large, and quite a few macroeconomic challenges will be pretty possible to persist into the foreseeable future. The pending 3-way split adds even more uncertainties. Last but not least, the present valuation delivers no obvious margin of basic safety. My closing verdict is a maintain ranking taking into consideration these uncertainties.

Q1 2022 Mixed Results

GE described blended final results for Q1 2022. On the optimistic facet, overall orders arrived in at $18.9B, a solid 13% growth YoY. And organic and natural revenue also grew a bit by 1%. Its Aviation and Ability segments are the shiny spots and noted double-digit expansion (far more on aviation in the subsequent portion). Having said that, on the damaging facet, totally free cash flow (“FCF”) is however in the negative (an outflow of $.9B). While it is an advancement of $1.7B from a year back, also note that the FCF advancement was after adjusting discontinued factoring and debt reduction steps.

Hunting forward, several of the troubles that plagued GE in the earlier quarters will incredibly possible persist, these types of as supply-chain issues, Russia / Ukraine war, and inflation. These elements push its FY 2022 outlook in the direction of the reduced-end selection it introduced before this year. As CEO Larry Culp commented for the duration of the earnings report (abridged and emphases additional by me).

I am proud of how our staff drove improved services, orders and dollars as we managed via increasing difficulties in the 1st quarter. Orders have been up 13% organically, with energy in equally solutions and equipment, and we saw double-digit expansion in Aviation and Electric power. Earnings was up a bit, driven by advancement in higher-margin services in all segments. We saw ongoing momentum at Aviation with earnings up double digits. This nevertheless was mainly offset by offer chain constraints in all segments, specially Health and fitness Treatment and Aviation, U.S. coverage uncertainty driving decreased Onshore Wind North American deliveries at Renewables this quarter and continued selectivity at Electricity.

GE 2022 Q1 earnings report

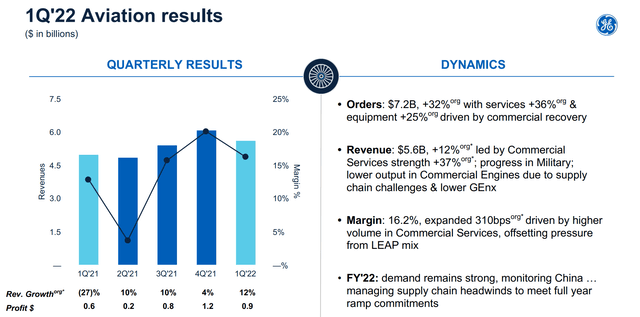

Aviation Is A Shiny Place

As the CEO commented, Aviation is certainly the dazzling place. And aviation is also the section that will carry the GE name and emblem right after the 3-way break up, as to be comprehensive future. Equally civilian and armed forces sales are solid. Especially, military gross sales really should be a top rated-line driver likely forward versus the backdrop of a heightened feeling of national protection all around the world. The aviation phase commenced its most up-to-date check marketing campaign of the XA100 adaptive cycle motor, intended to in good shape both equally the F-35A and F-35C jet fighters.

The commercial flight facet also saw an upward trajectory. GE aviation boasts the youngest and biggest industrial fleet and the most diversified providers portfolio in its heritage. In simple fact, about half of the company’s engines utilised on common Airbus and Boeing styles have not however been in for their to start with store stop by. As a result, there are good reasons to be expecting strong desire for forthcoming store visits and aftermarket companies. And shop visits and aftermarket products and services are also some of the most large-margin revenues. For instance, its Q1 outcomes claimed the margin in the aviation segment achieving 16.2%, a 310 bps expansion. And it attributed the growth generally driven by better volume in commercial products and services (with some offsetting stress from the LEAP mixes, though).

As CEO Larry Culp commented all through the Bernstein 38th Annual Strategic Conclusions Meeting shortly right after Q1 earning, GE aviation has shaped and will continue to condition the upcoming of flight. I invested a very good section of my specialist occupation in aerospace and aviation, and I tend to concur. Whilst, Culp reminded the viewers that GE sits on the “cusp of a article-pandemic recovery”, and a great deal relies upon on if/when the key airframers can ramp from right here.

I feel if you simplify the GE story nowadays, it just arrives down to a few management businesses very well positioned to just take advantage of what we see as a substantial growth runway in Aviation, Health care and in Electricity. Clearly, our Aviation business enterprise will form the potential of flight, always has and we are dedicated to carrying out that about the medium to extended expression. But right here, we sit definitely on the cusp of a post-pandemic recovery, equally in utilization of the present fleet. And as our significant airframers preparing to ramp from below.

GE 2022 Q1 earnings report

3-way Break up Provides Extra Uncertainty

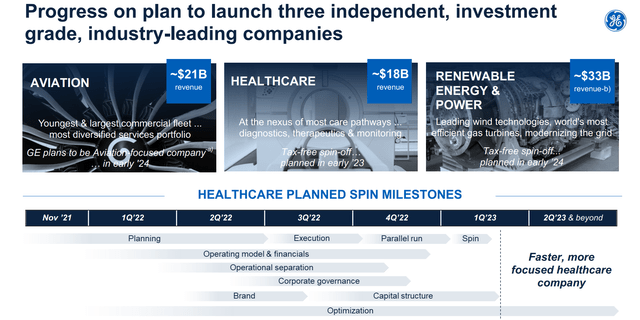

GE introduced its prepare to break up into three independent businesses back again in Nov 2021. As CEO Larry Culp said in the announcement,

By producing a few field-main, global public businesses, each and every can advantage from greater focus, tailored money allocation, and strategic overall flexibility to travel long-expression progress and price for customers, buyers and workforce.

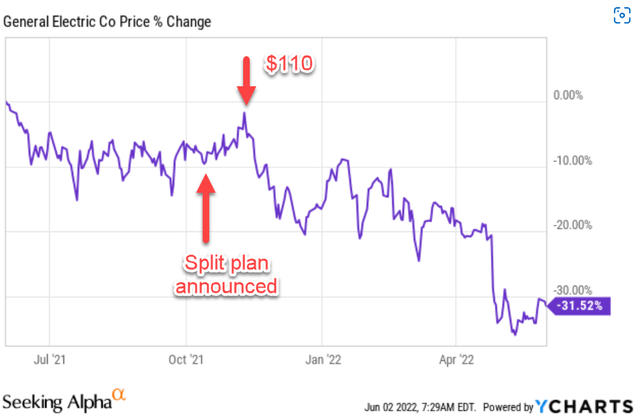

The market responses were certainly beneficial, at minimum in the beginning, as you can see from the pursuing chart. Its share charges rallied by just about 17% in premarket following the announcement and climbed to a peak close to $110 in the trading days shortly afterward.

On the other hand, the optimism was shorter-lived. A slew of damaging macroeconomic progress started off to transpire shortly afterward. Initially, the Russia/Ukraine war broke up. Then inflation commenced to operate absent, and the Fed commenced its approach to considerably tighten momentary supplies. At the same time, the world-wide supply chain disruptions persisted for a longer time than antedated and even worsened offered the China lockdown and the ripple outcomes of the Russian/Ukraine war. All instructed, the stock cost fell about 30% from its peak and is back again to the $70 to $75 level.

Looking forward, GE continue to maintains it 3-way break up plan and the timetable it introduced earlier. Precisely, the break up is scheduled to commence in 2023 when the health care business will turn into an impartial organization 1st. Then sometime in 2024, the electrical power and electrical power unit will be spun off, leaving the remaining aviation section as a standalone entity and carrying on the GE identify and symbol.

I did not share the market’s initial optimism about the break up-off then, and I however do not share it now. To me, these a complex spinoff only provides uncertainties for the two present and prospective investors. And the added benefits of the spinoff, if they do materialize as hypothesized, will not begin to occur in many years just after the spin has been completed.

Searching for Alpha

GE 2022 Q1 earnings report

Valuation

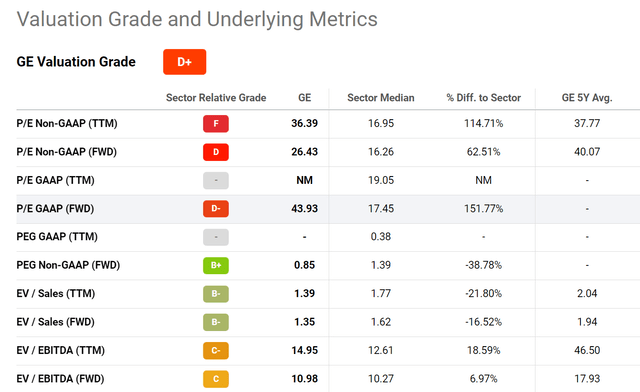

In phrases of valuation, GE is at present not at an apparent lower price, as you can see from the following table. All round, it is buying and selling at an elevated PE (in the range from 26x to 44x, dependent on which metric you choose). The valuation will be larger than what is proven listed here the moment its fairly high debt is factored in. And the pending spinoff provides more problems and uncertainties to the valuation. I do not see a apparent margin of safety at these value amounts.

Looking for Alpha

Remaining Views And Other Challenges

To me, financial investment in GE faces as well quite a few uncertainties as described over, each unknown and unknowable. However, I do not see a very clear valuation low cost and a very clear margin of security, which is the core rationale for my keeping score.

In addition to the dangers mentioned earlier mentioned, the sanction policies about Russia can make damaging results on GE’s profits, especially for its aviation and electricity companies. Mounting inflation and labor expense also creates force on its margins. Its CEO Culp has introduced strategies (which include value hikes) to fight the issue and maintain expenses under command. It stays unsure if these plans can be effective.