How to Make Financial debt Fewer High-priced When You Need to have It in a Crisis

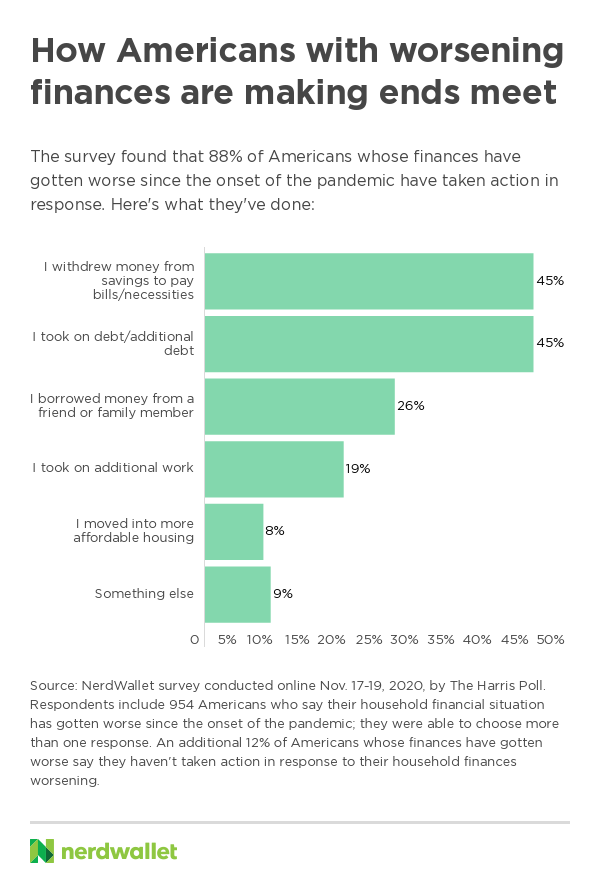

The coronavirus pandemic that upended the U.S. overall economy has resulted in common career and profits losses and added to the personal debt load for tens of millions of Us residents. Extra than 2 in 5 U.S. grown ups (42{b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146}) report that their house fiscal predicament has worsened considering that the pandemic’s onset, according to NerdWallet’s once-a-year household financial debt analyze, when just 14{b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146} say it has gotten improved and 43{b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146} say it is stayed the exact. Of all those who report a even worse problem, near to half (45{b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146}) say they’ve taken on debt simply because of it.

Using on financial debt might be unavoidable underneath the situation, but there may possibly be methods to lower the value of that personal debt in phrases of fascination or service fees. Dependent on your own scenario, you might have much more cost-effective or accessible choices.

For good/great credit: Harmony transfers, {b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146} credit score playing cards, individual financial loans

Harmony transfer credit history card gives got tougher to obtain for the duration of the pandemic as card issuers seemed to reduce their possibility. But all those with great credit to fantastic — normally described as credit scores of 690 or bigger — can nevertheless obtain them. If you have a balance you can’t moderately pay back off in the subsequent handful of months, transferring it to a card with a {b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146} introductory provide could enable you avoid desire for a 12 months or additional. Stability transfers usually incur a charge, however.

If you expect you could have to carry a credit history card stability in the in close proximity to future — for the reason that of a disruption in profits, for illustration — a card with a {b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146} introductory rate on buys can supply respiratory space for a yr or extra. For people who need more time, a minimal-fascination particular personal loan may be the greater decision. You can also use a own financial loan to consolidate present balances, building it a great alternative if the {b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146} time period on a harmony transfer card wouldn’t be extensive adequate for you to wipe out the debt ahead of the charge rises into double digits.

For good or poor credit history or no credit rating background: Unexpected emergency loans

If you require money fast but do not have a very good credit history heritage, an unsecured emergency bank loan may well be the way to go. Relying on your credit, these can have higher fascination prices, so this ought to be thought of as a fallback if you just cannot borrow from loved ones, get support from a nonprofit or spiritual group or qualify for a {b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146} credit card.

Customers of a neighborhood credit history union may possibly be in a position to get better phrases and reduce costs on an emergency loan, as they take into account your overall financial condition in its place of just your credit rating rating. Unexpected emergency financial loans may not be perfect from a expense standpoint, but they are there for those who really do not have good choices.

For these with 15{b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146} or additional residence equity: HELOCs

If you have adequate fairness in your household and want accessibility to credit, tapping a dwelling equity line of credit, or HELOC, will almost certainly be less pricey than piling up a credit history card harmony. A HELOC allows you to borrow versus your residence fairness, which is the value of your home minus the amount you owe on the property finance loan.

To qualify for a HELOC, you’ll generally will need fairness of at minimum 15{b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146} of your home’s value, a credit rating of 620 or greater and 40{b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146} or fewer for a credit card debt-to-earnings ratio, which is the percentage of your gross money taken up by debt obligations.

Desire costs on HELOCs are likely to be adjustable, so they can go up and down. Attempt to get estimates from a couple distinct loan companies so you know you’re obtaining the greatest prices obtainable. Fork out attention to the life span cap, which is the best amount you can be billed. If you never believe you can reasonably pay for payments at the optimum fee, it’s in all probability not truly worth it, as a HELOC carries a chance of shedding your home in foreclosures if you cannot repay your debt.

For professional medical expenses: {b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146} payment plans, medical credit score playing cards, income-primarily based hardship

Among the People in america who report worsened funds considering the fact that the onset of the pandemic, 14{b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146} say they took on healthcare financial debt or extra clinical credit card debt, according to NerdWallet’s study.

If you have remarkable healthcare bills, question your healthcare vendors if they provide payment strategies if so, discover out about curiosity or charges. Some suppliers will make it possible for you to make equal month to month payments in just your price range, which can be a very good choice if there are not costly fees tacked on to your balance.

When an reasonably priced payment approach is not an selection, a {b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146} fascination professional medical credit history card could assist you steer clear of curiosity for a specific time period of time (generally 6 to 12 months). Keep in brain that some healthcare playing cards cost deferred curiosity. This usually means that if you really do not pay the balance in whole by the time the no-fascination period expires, you will owe interest on the whole initial stability heading back again to the start out.

Based on your money, you may perhaps be eligible for a hardship system, which can reduce your payments as very well as the whole sum you owe. Talk to your provider if this possibility is out there.

For several unsecured balances: Personal debt administration strategies

A financial debt management system can be a very good alternative if you cannot fairly make your present credit score payments each individual thirty day period. You are going to work with a credit rating counselor who will be an advocate for you, attempting to get greater terms on your existing balances and consolidating your unsecured money owed into one regular payment you make to the credit history counseling agency in its place of to your lenders.

If you go this route, appear for a nonprofit company accredited by the Countrywide Basis for Credit rating Counseling. You will probably have to close your credit score card accounts when likely by way of a personal debt management plan.

For these who are unemployed: Credit rating unions, crisis reduction loans

Accessing credit is frequently most difficult for people who want it most, but there are possibilities for Us citizens who are unemployed. Area or regional credit rating unions might provide loans to assist get you via a challenging time, and Money Superior Fund presents a disaster relief financial loan that looks at your pre-pandemic employment and funds. Funds Very good Fund is offered in a limited quantity of states, but people residents may perhaps discover it to be just the lifetime raft they require.

Extra From NerdWallet

Erin El Issa writes for NerdWallet. E-mail: [email protected].

The write-up How to Make Financial debt Much less Highly-priced When You Will need It in a Crisis originally appeared on NerdWallet.

The sights and viewpoints expressed herein are the sights and thoughts of the writer and do not essentially reflect these of Nasdaq, Inc.