Best bank for small business 2021: Find the right bank

When you run a small business, banking is about more than just the regular banking experience. Suddenly you need to keep in mind additional features geared toward helping your small business succeed.

A major service banks provide to small businesses is the perks offered with certain credit cards, since cashback and mile rewards can help your business thrive. Every small bit of help towards your bottom line counts.

On top of credit card offerings, you’ll need to assess what types of savings and checking accounts are available, whether the bank offers loans and if the bank even helps with merchant services. Below are our top picks for the best banks for small businesses that offer these services and more.

Chase stands out as one of the best banks for small businesses for its business credit card rewards. Certain cards offer 100,000 bonus points, and you can earn three times the points when you spend on shipping and certain business categories. Some also offer $750 bonus cash back, and you earn 5{b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146} cashback in certain business categories.

The company also offers a wide variety of business checking accounts that come with certain perks. For instance, the Chase Business Complete Banking option has a built-in card acceptance. You have options that allow you to waive the monthly service fee, like keeping a minimum daily balance.

Chase also has other peripheral services, like merchant services that help you manage an eCommerce site with payment processing and help you take payment in a retail setting. You can also find a wide variety of financing options through Chase for business lending, like lines of credit, business loans, real estate lending and SBA solutions.

Pros

- One of the largest and most well-known banks, brick and mortar locations are everywhere.

- Business credit cards offer plenty of perks.

- Wide variety of checking accounts and services for just about any type of business.

Cons

- A checking account comes with fees unless you keep a daily balance, like a $35,000 daily balance for the Chase Performance Business Checking account.

- JPMorgan Chase & Co. is the largest bank in America, which might feel too impersonal to people looking for a more local banking experience.

- Business offerings are for a wide variety of business types, so you have to know what you are looking for in an account and services.

Wells Fargo is another established, well-known bank that specifically lists out solutions for small businesses. It has a wide range of business banking solutions, like business checking, savings and CDs and a business debit card. There are no annual fees to the business debit card, and you can use it at a Wells Fargo ATM or a non-Wells Fargo ATM that has a Visa or Plus logo.

Wells Fargo also has a wide variety of loan and credit options, like business credit cards, business lines of credit, SBA loans, commercial real estate financing and letters of credit. If you spend $3,000 in the first three months of opening the Wells Fargo Business Platinum Credit Card, you can get $300 cashback or 30,000 bonus points. You also can get 1.5{b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146} back on every $1 spent, and you get 1,000 bonus points when you spend $1,000 or more in a monthly billing period. There is also a 0{b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146} introductory rate for the first nine months.

Wells Fargo also has a secured credit card with no annual fee. There is also a variety of checking options to choose from to fit your business needs.

This bank also has merchant services like payment processing options. You can even choose from payroll and more services like retirement investing, making it one of the best banks for small businesses.

Pros:

- Offers many options and services specifically for small businesses.

- Options allow you to avoid pesky annual fees.

- This is another larger bank with many different ATM and service locations.

Cons:

- This is the third-largest bank in the nation, making it another poor option for anyone looking for a small, local experience.

- Most perks on the business credit cards require a high degree of business spending, like $1,000 per month, with might not be a good option for businesses with very low overhead.

Attractive credit card options

The credit cards come in three main tiers, offering a 1{b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146}, 1.5{b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146} and 2{b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146} cashback respectively. All three cards have unlimited cash back, and the 1{b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146} card and 1.5{b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146} card have a $0 annual fee. The highest 2{b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146} card has a $95 annual fee after the first year. The cards have a variable APR that ranges around 25{b530a9af8ec2f2e0d4045baab79c5cfb9bfdc23e498df4d376766a0b44d3f146}.

Two credit card options are heavy on mile rewards, making them good if you travel for business frequently.

Capital One also features merchant services to help you accept payments, monitor fraud and handle customer data insights.

Pros

- Wide variety of credit card offerings.

- Additional services like merchant services.

Cons

- Some places might receive the message that Capital One is still working on bringing online business banking to their area.

- It’s hard to find information about business checking and savings accounts online.

- This service is mainly known for its credit cards, so you may have to check elsewhere for business loans.

Axos prides itself on what it calls “technology-driven finance,” which the company has been doing since 2000. If online banking is a priority for your business, you might want to look into Axos as one of the best banks for small businesses.

Axos is notable for its wide variety of small business banking options, like checking account options, small business savings accounts, money market accounts and small business CDs and CDARS. The company is currently running a promotion to get a $100 bonus if you incorporated your business after June 1, 2020.

The company also has a wide variety of options for commercial lending, like commercial lines of credit and commercial term loans. Additional services like treasury management and merchant services to help with payment processing round out the offerings.

Pros

- Axos is very mobile and online banking heavy.

- There are a wide variety of options you don’t see everywhere, like business CDARS and money market accounts.

Cons

- If you like being able to go up the street to the local branch, this isn’t that sort of bank.

- Having so many options for your business means you really have to do your research and know what products make sense for your type of business.

Geared towards freelancers and entrepreneurs

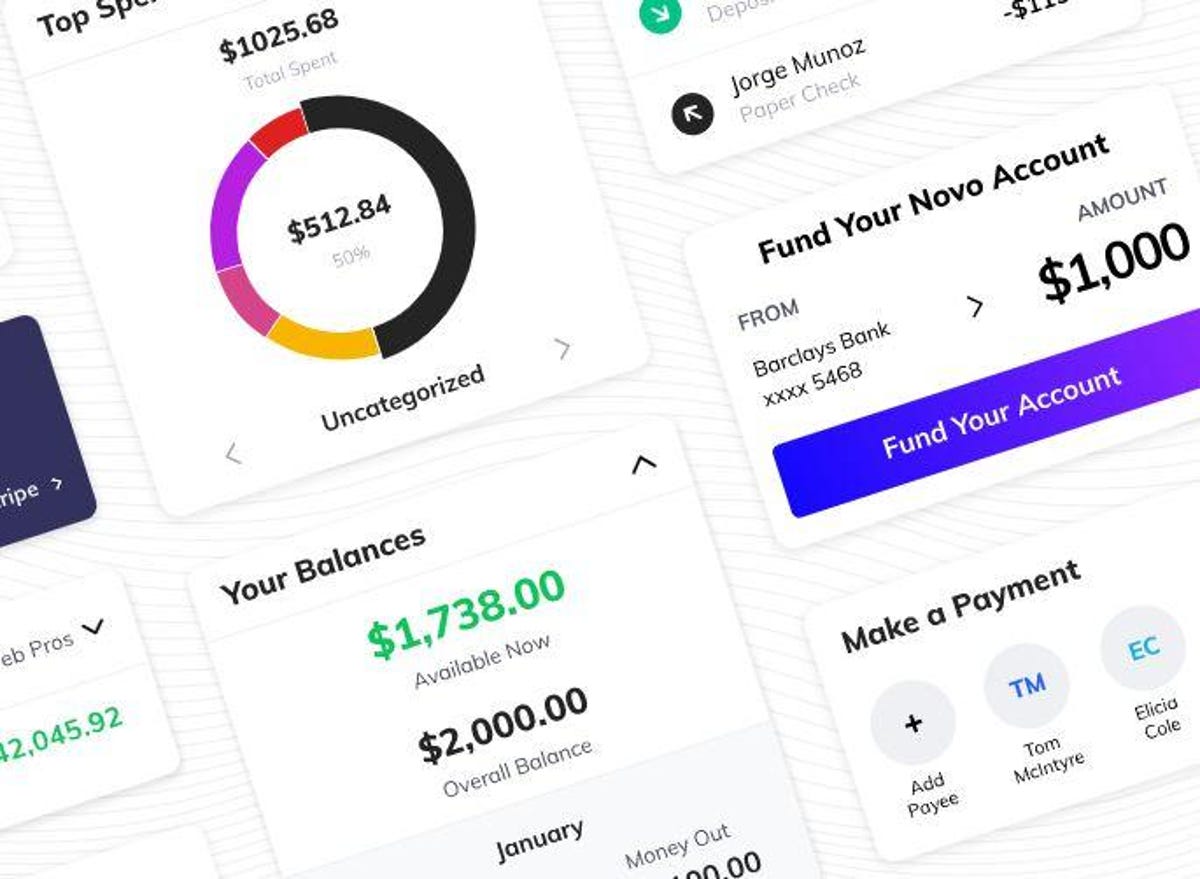

Novo is an all-digital banking service that focuses on the needs of small business owners, entrepreneurs and freelancers. As a service that caters to bootstrappers and those who might not have regular paychecks, the service has no monthly fees or minimum balance requirements. A major perk is that it refunds all ATM fees. It also offers free transfers, incoming wires and mailed checks.

It’s backed with FDIC insurance, and you can apply for an account in under 10 minutes. It also claims no hidden fees, which is a great benefit over more traditional bank experiences.

The app also integrates with other business programs, like Slack, Stripe, Shopify and

Pros:

- Good low-to-no fee service.

- One of the few services that caters to freelancers.

- Perfect for anyone who uses online banking exclusively, as well as digital bookkeeping and project management.

Cons:

- Not a good option for anyone who likes physical bank locations.

- Novo’s BBB listing has only been active since May of 2020, and the company is not BBB accredited.

- It is just a banking app, so you would need to look elsewhere for lending options.

How did we choose these banks?

When looking at the best banking service, we kept in mind which banks were the most well-known and established. Then we looked at the variety of offerings.

When searching for the best banks for small businesses, we considered:

- Credit cards that meet small business needs

- Amount of savings and checking options specifically for small businesses

- The types of fees a small business owner would have to pay

- Which loans and other lending options the bank offered to small businesses

- Whether the bank specifically listed small business solutions on its website

- What types of small businesses the service supported, like whether they were for more traditional small businesses or freelancers/sole proprietors

Well-established banks with a wide variety of product offerings for small businesses tended to make the list, with smaller additions for banks that have a comprehensive online experience or catered to specific types of small business owners that others didn’t.

Which bank is right for you?

Take a look at our recommendations for the best banks for small businesses based on which services are important to you.

Physical locations: Chase and Wells Fargo are the best choices if you want the kind of banking experience where you can find a physical location right up the road in most cases. Chase and Wells Fargo both have thousands of branch locations across the U.S.

Credit card rewards: Capital One is known for its flexible credit card offerings. Chase and Wells Fargo also have good rewards on their credit cards.

Comprehensive online banking experience: If online banking is for you, choose Axos or Novo, both of which focus on technology-centered banking.

Low-to-no fees: Novo stands out as a banking app that advertises low-to-no fees and no hidden fees.

Wide variety of checking and savings account options: Chase, Wells Fargo and Axos are notable for their small business CDs. Chase has a truly wide variety of checking and savings options, however.

Loan needs: Wells Fargo stands at the top of the list for a wide variety of loan options, including SBA loans, like the SBA 7(a) loan.

How to decide which bank to choose

Look at which services seem the most appropriate for the way you conduct business. For instance, if you are a sole proprietorship with low expenses, accounts that have high monthly balances and transaction requirements to get rewards won’t be the best product for you.

However, if you have a high amount of transactions and a high monthly balance, those accounts would make sense. As another example, if you have a retail part of your business, also look into a bank that offers merchant services.

What is the difference between small business banking and regular banking services?

Small business banking takes the needs of small businesses into account. It offers different services and perks that are more applicable to small businesses, like some banks offer POS merchant services support. Other services are tailored to small business uses, like rewards and cashback are set up to take into account a high volume of transactions or higher monthly balances than an individual would have.

You will especially look into small business banking solutions if you need loan options, like an SBA loan.

Is online or physical banking better?

Whether you choose, online or physical banking is up to personal preference. Online banking can be good for anyone on the go who isn’t always near a physical location or someone who just doesn’t want to take the time to run to the bank.

Physical banking can be a good option if you like to have a live person to help you review your options in person or feel more secure using physical banking.

Should you get a savings account for your small business?

You may wonder what the point of a savings account is if you are running a small business since money may constantly be coming and going. However, a savings account for a small business can have a number of benefits. For instance, it can be a good way to set aside cash as an emergency fund for lean times or other hardships with the business.

It can also help you keep track of money that you might use later to invest in certain parts of your business. A massive perk is that small business savings accounts allow you to build interest in your saved money.

Does it ever make sense to pay fees with a bank?

A major hassle with banks is that they tend to have many fees, some of which are not mentioned upfront. Fees tend to become more common the more cashback and rewards you get with an account or card. If you have high use on a checking account or credit card, for instance, you stand to gain more in cashback or rewards points.

As such, the cashback and rewards might exceed the annual fee. However, if you have low expenses, then you might want to look into a service that advertises low-to-no fees and no hidden fees.

Are there alternative banks worth considering?

There were some other banks that are worth considering, but they didn’t make the list either because their offerings weren’t as comprehensive or they weren’t as well-known/established.

Below are some of the additional best banks for small businesses you might consider: